Washington, D.C. – U.S. News & World Report and Best Lawyers, for the 10th consecutive year, collaboratively announce the release of the “Best Law Firms” rankings. This is the second time in less than two years that the Kim & Lahey Law Firm has been recognized for this honor.

Washington, D.C. – U.S. News & World Report and Best Lawyers, for the 10th consecutive year, collaboratively announce the release of the “Best Law Firms” rankings. This is the second time in less than two years that the Kim & Lahey Law Firm has been recognized for this honor.

More Emergency Funding For Small Business

US Senate Expected to Close the Deal Today

The SC Chamber of Commerce has released a statement informing business owners that US Senate Democrats and Republicans are close to a deal for additional funding for the Paycheck Protection Program (PPP). The package, expected to be passed today in the Senate by unanimous consent, will likely allocate close to $400 billion total including funding for:

The SC Chamber of Commerce has released a statement informing business owners that US Senate Democrats and Republicans are close to a deal for additional funding for the Paycheck Protection Program (PPP). The package, expected to be passed today in the Senate by unanimous consent, will likely allocate close to $400 billion total including funding for:

- PPP

- Economic Injury Disaster Loans (EIDL)

- Hospital assistance

- COVID-19 testing

PPP Recap

Nationally:

- Approval of 1,661,367 loans

- Approval of $342.3 billion in loans (does not reflect the amount required for reimbursement to lenders per statute within the CARES Act.

- 4,975 lenders have processed approved loans

- Overall average loan size is $206,000

Top five sectors receiving loans:

- Construction (13.12%)

- Professional, Scientific, and Technical Services (12.65%)

- Manufacturing (11.96%)

- Health Care and Social Assistance (11.65%)

- Accommodation and Food Services (8.91%)

In South Carolina:

- Approval of 22,933 loans have been approved

- Approval of $3.81 billion in loans

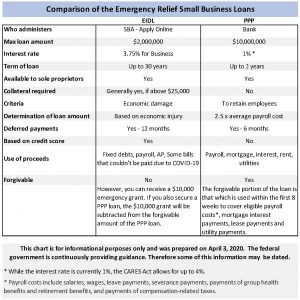

Making Sense of SBA Emergency Assistance Loans

We understand many of you are trying to figure out how to best protect your family and business during this difficult time. Many of you are now eligible for relief. We stand by our clients and are here to help you determine your best strategy.

The Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) is the largest federal relief package in history and provides financial support and tax incentives for small businesses.

What types of loans are available?

Two of the loans available through the Small Business Administration are the Economic Injury Disaster Loan (EIDL) and the Paycheck Protection Program (PPP).

There is a forgiveness structure that can effectively turn a portion of the PPP loan into a grant and you may be eligible for a $10,000 emergency grant by applying for the EIDL.

It is important to determine which loan is right for your business. We can guide you through the process to help you achieve the best outcome.

We offer a consultation service that covers the following:

- Business Assessment

- Loan Strategy Discussion

- Review Required Document Checklist

- Business Documentation Review

- Loan Application ReviewSBA Emergency Loan Comparison-Final

Email Attorney Jason Rosen for more information: [email protected].

Who Qualifies?

- A small business with fewer than 500 employees

- A small business that otherwise meets the SBA’s size standard

- A 501(c)(3) with fewer than 500 employees

- An individual who operates as a sole proprietor

- An individual who operates as an independent contractor

- An individual who is self-employed who regularly carries on any trade or business

- A Tribal business concern that meets the SBA size standard

- A 501(c)(19) Veterans Organization that meets the SBA size standard

In addition, some special rules may make you eligible:

- If you are in the accommodation and food services sector (NAICS 72), the 500-employee rule is applied on a per physical location basis

- If you are operating as a franchise or receive financial assistance from an approved Small Business Investment Company the normal affiliation rules do not apply

REMEMBER: The 500-employee threshold includes all employees: full-time, part-time, and any other status.

What documentation may you need?

While our firm is awaiting further guidance from the federal government regarding the loan application process, collecting the documents below is a good place to start. Insufficient documentation could delay the loan application. This list may change as more information becomes available.

- 2019 IRS Quarterly 940, 941 or 944 payroll tax reports

- Payroll reports for a twelve-month period (ending on your most recent payroll date), which will show the following information:

Gross wages for each employee, including officer(s) if paid W-2 wages.

Paid time off for each employee

Vacation pay for each employee

Family medical leave pay for each employee

State and local taxes assessed on an employee’s compensation

- 1099s for independent contractors for 2019

- Documentation showing total of all health insurance premiums paid by the company owner(s) under a group health plan. Include all employees and the company owners.

- Document the sum of all retirement plan funding that was paid by the company owner(s) (do not include funding that came from employees out of their paycheck deferrals). Include all employees and the company owners. Also include 401K plans, Simple IRA, SEP IRA’s.

- Company bylaws or operating agreement

US Patent & Trademark Office Waives Fees in Response to Coronavirus Outbreak

The United States Patent and Trademark Office (USPTO) issued a notice on March 16th to offer relief for certain inventors and entrepreneurs who were affected by the Coronavirus outbreak. The notice states the USPTO “considers the effects of the Coronavirus outbreak that began in approximately January 2020, to be an extraordinary situation within the meaning of 37 CPR 1.183 and 37 CPR 2.146 for affected patent and trademark applicants, patentees, reexamination parties, and trademark owners.”

Patent applicants will be able to file a petition to revive and the PTO will waive the fee for those who were unable to “timely reply to an Office communication due to the effects of the coronavirus outbreak, which resulted in the application being held abandoned or the reexamination prosecution terminated or limited.”

The petition to revive must include a copy of the notice and a statement that “the delay in filing the reply required to the outstanding Office communication was because the practitioner, applicant, or at least one inventor, was personally affected by the Coronavirus outbreak such that they were unable to file a timely reply.” The petition must be filed no later than six months after the date the application became abandoned or the reexamination prosecution was terminated or limited in order to be entitled to a waiver of the petition fee under 37 CPR 1. l 7(m).

The USPTO is also waiving fees for trademark applications and registrations that were abandoned or canceled/expired due to inability to timely respond to a trademark-related Office communication as a result of the effects of the Coronavirus outbreak, however, the petition must be filed no later than two months of the issue date of the notice of abandonment or cancellation. Download the full notice: coronavirus_relief_ognotice_031620201.

Questions or concerns about your Patents or Trademarks? Call us at 864-973-6688 for a consultation.

Kim & Lahey Law Firm Named to “Best Law Firms” List 2020

Firms included in the 2020 Edition of U.S. News – Best Lawyers “Best Law Firms” are recognized for professional excellence with consistently impressive ratings from clients and peers. To be eligible for a ranking, a firm must first have a lawyer recognized in The Best Lawyers in America©, which recognizes the top 5% of private practicing lawyers in the United States. Achieving a tiered ranking signals a unique combination of quality law practice and breadth of legal expertise.

“Choosing the right law firm can be a vital decision,” said Tim Smart, executive editor at U.S. News & World Report. “The rankings draw on U.S. News’ 35 years of experience evaluating complex institutions to help individuals and companies alike make the best decisions.”

The 2020 rankings are based on the highest number of participating firms and client votes received on record. Almost 16,000 lawyers provided more than 1,229,000 law firm assessments, and more than 12,000 clients participated providing 107,000 evaluations.

“For the 2020 ‘Best Law Firms’ publication, the evaluation process has remained just as rigorous and discerning as it did when we first started ten years ago.” says Phil Greer, CEO of Best Lawyers. “This year we reviewed 14,931 law firms throughout the United States – across 75 national practice areas – and a total of 2,106 firms received a national law firm ranking. We are proud that the ‘Best Law Firms’ rankings continue to act as an indicator of excellence throughout the legal industry.”

Using A.I. to Slash Shipping Costs | 2019 Supply Chain Innovation Award Winner

You’ve heard of SEO. How about SCO? It stands for Shipping Cost Optimization, a patent pending method of using artificial intelligence to slash shipping costs. This homegrown innovation, called IntelliPack, has thrust local entrepreneur, John Peck, CEO, President, & Co-Founder of FastFetch Corporation into the national spotlight.

Peck joined Katie Neau, RCI Supervisor of Snap-on Tools at the Council of Supply Chain Management Professionals’ (CSCMP) EDGE 2019 Conference on September 18, 2019, in Anaheim, California, for their presentation about “Using Artificial Intelligence to Slash Shipping Costs.” They beat out Silicon Valley giant Intel Corporation, as the winners of the 2019 Supply Chain Innovation Award (SCIA) .

Snap-on Tools is saving 11% annually on total shipping costs at its distribution center in Crystal Lake, IL. The initiative employs artificial intelligence to minimize wasted space in shipping cartons as well as new logistical processes to cut corrugated material costs by 20%, dunnage costs by 27% and packing labor costs by 30%. Peck says companies like Snap-on Tools often save an average of $18,000 per month on small parcel carrier shipping costs using his patent pending packing process.

It took Peck about six months to develop the new method. He says, “You have to be able to calculate the best box size for shipping an unpredictable collection of items of given sizes in less than a second. When someone orders online, that one order may have eight to 10 things in it. Each comes in different shapes and sizes and there are more than 100 boxes to choose from. Using the right size box is important.”

Doug Kim represents FastFetch. He says, “Because it’s our job to help with intellectual property protection, we get to see these inventions very early on. It’s exciting to see our clients be successful, to see an idea go from conception to commercialization.”

Peck’s method of using A.I. to slash shipping costs can virtually figure out how to place the items in the best sized box. “It’s going to make e-commerce affordable,” says Peck. “Consumers want free shipping, but someone has to pay for it. Our method ensures there is minimal wasted space. Smaller boxes means more packages can fit in each shipment. Instead of needing multiple trips, using multiple trucks or airplanes, now more can fit into each trip and that will help shipping companies become more efficient too.”

Congratulations to the entire FastFetch team! Watch the video below to see SCO in action.

Kim & Lahey Continues to Expand

As business becomes more sophisticated, more of you are reaching out for answers to complex questions, seeking advice on how to handle cutting-edge problems. Taking care of business in this digital age is less intimidating with a multifaceted, dedicated legal team by your side.

As business becomes more sophisticated, more of you are reaching out for answers to complex questions, seeking advice on how to handle cutting-edge problems. Taking care of business in this digital age is less intimidating with a multifaceted, dedicated legal team by your side.

We want to understand your business so that we can assist in legal strategies that align with your business goals. We want to solve problems before they occur and knowing your business helps us better identify and avoid risks. Bringing real-world business experience, our attorneys can better assist you in meeting those business goals, including our newest member, Jason Rosen. He joins our team with over 15 years’ experience as an attorney and securities and financial services professional.

Whether you’re a startup or a major manufacturer, Jason will help us better serve your legal needs associated with day-to-day operations, vendors, customers, employees, independent contractors, business transactions and sales, as well as founder, owner and management disputes and issues.

He moves to Greenville, South Carolina, after living in Florida, where he is also a licensed attorney. Additionally, Jason is credentialed in California, New York, South Carolina and soon to be North Carolina.

Please join us in welcoming Jason Rosen, along with his wife and daughter, to the Kim & Lahey family!

Learn more about Jason and how he can help meet your business legal needs.

Douglas Kim Recognized by The Best Lawyers in America® 2020 for Patent Law and Trademark Law in Greenville, SC

Greenville, S.C. — August 15, 2019 —Doug Kim, a longtime intellectual property attorney in the Upstate area, has been selected by his peers for inclusion in The Best Lawyers in America® for 2020 in the fields of Patent Law and Trademark Law in Greenville, SC.

Since it was first published in 1983, Best Lawyers® has become universally regarded as the definitive guide to legal excellence. Best Lawyers lists are compiled based on an exhaustive peer-review evaluation. Almost 94,000 industry leading lawyers are eligible to vote (from around the world), and we have received over 11 million evaluations on the legal abilities of other lawyers based on their specific practice areas around the world.

For the 2020 Edition of The Best Lawyers in America, 8.3 million votes were analyzed, which resulted in more than 62,000 leading lawyers being included in the new edition. Lawyers are not required or allowed to pay a fee to be listed; therefore, inclusion in Best Lawyers is considered a singular honor. Corporate Counsel magazine has called Best Lawyers “the most respected referral list of attorneys in practice.”

“I am honored to have been recognized by Best Lawyers especially since this is a peer review award.” says Doug. Based in Greenville, South Carolina, the Kim and Lahey Law Firm, LLC, which was founded by Doug and Seann Lahey in March of 2018, assists clients with legal services including intellectual property protection both domestically and internationally. Working with clients to understand their business, their needs and customize legal solutions that best achieve their goals and budgets, Doug’s practice focuses on client-centric strategies involving patents, trademarks, copyrights, trade secrets, enforcement, licensing, contracts, privacy policies, and website terms and conditions.

Doug is also the Chair of the South Carolina Bar Intellectual Property and Innovation Committee. “Through organizations like the SC Bar IP and Innovation Committee, I hope to help other attorneys and clients increase their awareness of the importance of a good IP strategy and build relationships that help the profession and clients navigate the increasingly complete legal landscape.”

Providing Legal Services to Help Revolutionize Business and Empower Entrepreneurs.

Increase in Software License Disputes Expected to Continue in 2019

In our practice we are seeing an increase in software license disputes between software vendors and users. It seems that the main reason for the increase in disputes is the change in technology, which has changed the way in which software is created, distributed and used. This problem is aggravated by either current license agreements not being updated to reflect these changes or by vendors making license terms more onerous for users.

Technology is creating a need to modify and update license agreements.

The technological changes that are at the root of this increase in disputes include the rapid increase in cloud computing and virtualization of software. License agreements that were user based, seat based or even enterprise based do not fit well with the cloud/virtualization model. In response, software vendors are seeking to identify the actual number of user or copies by exercising their audit rights which users typically try to resist, thus creating tension between the vendor and the user. When creating, distributing or using software, it is wise to focus on the licensing model being used as well as how it fits into the existing IT system. As more and more software moves to the cloud and license agreements are not updated, we can expect to see license disputes increase.

Vendors are changing their licensing terms.

For example, Java, one of the most widely adopted programming languages (Indeed reported in 2016 that it was the second most sought after skill for programming) had its license changed so that Oracle JDK is free to individuals for use, development, testing, prototyping and demonstrations, but now requires a commercial license to avoid the GPLv2+CE license. The GLPv2 license requires that all the source code be made public, which completely removes any ability to prevent others from using your source – an outcome not very popular with most software vendors seeking to license their software.

We are also seeing license terms being used aggressively where some vendors are seeking to make up for lost revenues caused by the open source model. Software developers, that charge for their time, turn to open source for efficiencies that can increase profits and allow savings to be passed to customers. However, some of the open source licensing is being modified without the user’s knowledge, creating significant legal and financial issues.

For example, some software licenses have clauses along the lines of “[Vendor] expressly reserves the right to modify the Terms of Service at any time in its sole discretion by including such alteration and/or modification in these Terms of Service, along with a notice of the effective date of such modified Terms of Service.” The issue is that the individual in an organization that approves licenses is typically not the user that would encounter the “modified Term of Services.” So terms change without the company’s knowledge. In one case, we saw the license go from free to thousands of dollars per user. The user simply would not have used the software in the first place, had it known of this change and is now in the process of removing the software from its product.

The Recent Supreme Court may increase Software copyright disputes.

In March, the Supreme Court clarified that to bring a copyright infringement case, the copyright holder must have the copyright registration in hand. This changed the rule in many areas of the country that allowed for the copyright holder to simply have an application on file. If software vendors begin to apply for and secure copyrights upon the creation of software (as they should), they will be entitled to attorney fees and statutory damages (recovery up to $150K per infringement without proving actual damages). Under the old rule, where only the application in file was needed, the ability to recover attorney fees and statutory damages we largely lost. Knowing that the recovery of attorney fees and statutory damages are available, vendors may not be likely to use copyright infringement to more aggressively enforce their licensees or even instigate litigation.

What’s next? Prevention!

- Review the policies within your organization as to how software is used and downloaded. For example, can anyone download software and click “I Agree” and bind the company to the licenses?

- Review the existing license agreement and amendment, renegotiate or even cancel as appropriate. We are even seeing software vendors elect to use the laws of other countries to benefit for more advantageous legal structure than those in the US. For example, because Canada can allow for the modification of the license with only notice to the user, some vendors are electing to use Canadian law (localization). In 1984, Louisiana enacted the Software License Enforcement Act (SLEA) which, among other terms, state that a software license agreement can ONLY be enforced if: (a) the user can clearly read a software license notice on the software packaging; (b) the software license notice indicates that by opening the package or using the software the end user accepts the terms of the enclosed license agreement and (c) the notice states that the software may be returned if the end user does not accept the license agreement. Note how this law does not fit cloud-virtualization very well.

- At the software design stage for customer software, understand the open source used, third party software used, third party licenses needed, and the effect of the rest of the IT system already in place. For example, does the custom project legally allow for cloud-virtualization? Does the software architecture need seat licenses, enterprise, cloud, or some other license structure?

- Work with an experienced attorney that understands software, software licensing and the trends in this area.

- Act early, users can typically have a better position in negotiating when the potential issues are identified pre-dispute and can resolve the potential dispute with the vendor. Vendors can better service users when the business and legal relationship is clearly understood, and unauthorized use is avoided.

If you have any questions regarding this article, contact Doug Kim, 864-973-6699, [email protected].

Doug Kim, a Physics major from Davidson College, began his professional career as a computer programmer and software engineer. His intellectual property career began in 1998, when he combined his business experience with his legal education and was involved with enforcing a client’s patent against multiple infringers. Since then, Doug has created a well-rounded IP practice that provides legal solutions and strategies tailored to each client from multinational corporations to start-ups. Doug provides his clients with strategies to protect inventions (patents), brands (trademarks), websites, software, apps, music, photos, and websites (copyright, licenses and Internet law), and trade secret (the “secret sauce”).

These materials have been prepared for informational purposes only and are not legal advice. This information is not intended to create, and receipt of it does not constitute, an attorney-client relationship. Internet subscribers and online readers should not act upon this information without seeking professional counsel.

Watch Kanga Compete on Shark Tank

Teddy Giard, Logan LeMance and Austin Maxwell set to pitch their product, the Kase Mate, on the Sunday, April 7, episode of “Shark Tank.”

Like many young people, Logan LaMance had a decision to make his freshman year in college. He could continue focusing on freedom and fun or get serious and shoot for the stars. He chose the latter and it paid off. This Sunday, Logan and his partners at Kanga, LLC, will appear on Shark Tank. Their pitch? Kanga’s Kase Mate is described as a “koozie for a case of beer.” Their marketing slogan is, “Kooler than a cooler and keeps drinks cold for up to 7 hours without ice.” You get the point, but how did they get to this point?

Logan was born and raised in Pickens, SC. He started taking classes at Clemson during fall 2014. Logan says it was the end of that first semester when he realized he needed a change in direction. The following semester he was part of an internship program lead by Young Entrepreneurs Across America, that teaches students how to start and run a business. It was a house painting business called Student Painters, LLC.

Logan worked harder over the next two years than he ever had before in his life. He put in between 30 – 40 hours per week on school work and every other waking moment was spent on his business. Logan said it was a tough place to be, both mentally and physically taxing, but he was driven and had a dream. He says, “The thing I am the proudest of is not that I brought the biggest business or made the most money, but that I fought through it, never quit and learned a lot of valuable lessons along the way.”

That’s when he caught the bug. After running a grueling, yet successful painting business with other students for two years, he was sick and tired of paint brushes, but he knew he wanted to be an entrepreneur. During the spring of 2017, Logan took an entrepreneur class that would change his life. The class project was to create a solution for a problem that people face. Logan says finding a good idea wasn’t easy.

Then came football season. Logan and his friends were on their way to tailgate. They stopped to grab a couple 12-packs on the way. They all had coolers back at their apartments, but they didn’t want the hassle of carrying a heavy, clunky cooler a mile from home to the tailgate and back, which meant they ended up drinking warm beer before long. Logan thought to himself, “Why are we drinking warm beer? That’s a problem.” He had to find the solution next.

Logan says he saw someone take a cold beer out of a cooler and put it into a koozie and that’s when it hit him. Logan wondered, “Why don’t we have the same thing for the whole case? We got it from the fridge (what made it cold), why don’t we have something to put it in to keep it cold for the whole time we’re actually going to enjoy it?”

That’s how Kanga was born. He pitched the idea to his class and convinced them it was bigger than a class project. They created a prototype and worked with mentors through the Spiro Institute to take their idea and turn it into a business.

Doug Kim, Kanga’s intellectual property attorney of the Kim and Lahey Law Firm, says, “I met the owners of Kanga, LLC through my work with the Clemson Venture Program and was immediately impressed with their inventions, marketing acumen and business decisions. To see these business owners accomplish so much while also attending college, should be inspiring for everyone.”

Kanga started with a short run of 100 units to test the market and see if people would actually buy it, and they did. From there, Kanga won a first-place prize of $8,000 at Clemson’s “The Pitch Smackdown,” which Logan describes as a mini shark tank where they also picked up their first investor.

Fast forward to when Kanga had a successful Kickstarter campaign in 2018, and now, as they’re only two days away from appearing on the real Shark Tank on ABC. Logan says, “If we can do it with a koozie for a case of beer, image what other ideas can do.”

The Shark Tank episode airs at 10pm EST, Sunday, April 7.

This article is for informational purposes only. Any result achieved for one client does not necessarily indicate that similar results can be achieved for any other client. Kim and Lahey Law Firm, LLC has designated Douglas W. Kim as the person to contact for information regarding this article. He may be contacted at 864-973-6688 or at [email protected].

Doug Kim Selected to 2019 SC Super Lawyers List

Douglas Kim, Partner, Kim and Lahey Law Firm, LLC

Douglas Kim, a longtime intellectual property attorney in the Upstate area, has been selected to the 2019 South Carolina Super Lawyers list. Each year, no more than five percent of the lawyers in the state are selected by the research team at Super Lawyers to receive this honor.

Super Lawyers, a Thomson Reuters business, is a rating service of outstanding lawyers from more than 70 practice areas who have attained a high degree of peer recognition and professional achievement. The annual selections are made using a patented multiphase process that includes a statewide survey of lawyers, an independent research evaluation of candidates and peer reviews by practice area. The result is a credible, comprehensive and diverse listing of exceptional attorneys.

Based in Greenville, South Carolina, Doug started his own law firm in March of 2018. Soon after, he partnered with longtime friend and colleague, Seann Lahey, in what is now the Kim and Lahey Law Firm, LLC. They assist clients, both domestically and internationally, who are looking to safeguard innovative ideas or inventions, secure their brand’s identity, or otherwise need to protect their business interests. They take a client-centric approach toward understanding a client’s needs in order to create customized legal solutions involving patents, trademarks, copyrights, trade secrets, enforcement, licensing, contracts, privacy policies, and website terms and conditions.

Doug also serves as the Chair of the South Carolina Bar Intellectual Property and Innovation Committee.

The Super Lawyers lists are published nationwide in Super Lawyers Magazines and in leading city and regional magazines and newspapers across the country. Super Lawyers Magazines also feature editorial profiles of attorneys who embody excellence in the practice of law. For more information about Super Lawyers, visit SuperLawyers.com.