More Emergency Funding For Small Business

US Senate Expected to Close the Deal Today

The SC Chamber of Commerce has released a statement informing business owners that US Senate Democrats and Republicans are close to a deal for additional funding for the Paycheck Protection Program (PPP). The package, expected to be passed today in the Senate by unanimous consent, will likely allocate close to $400 billion total including funding for:

The SC Chamber of Commerce has released a statement informing business owners that US Senate Democrats and Republicans are close to a deal for additional funding for the Paycheck Protection Program (PPP). The package, expected to be passed today in the Senate by unanimous consent, will likely allocate close to $400 billion total including funding for:

- PPP

- Economic Injury Disaster Loans (EIDL)

- Hospital assistance

- COVID-19 testing

PPP Recap

Nationally:

- Approval of 1,661,367 loans

- Approval of $342.3 billion in loans (does not reflect the amount required for reimbursement to lenders per statute within the CARES Act.

- 4,975 lenders have processed approved loans

- Overall average loan size is $206,000

Top five sectors receiving loans:

- Construction (13.12%)

- Professional, Scientific, and Technical Services (12.65%)

- Manufacturing (11.96%)

- Health Care and Social Assistance (11.65%)

- Accommodation and Food Services (8.91%)

In South Carolina:

- Approval of 22,933 loans have been approved

- Approval of $3.81 billion in loans

Making Sense of SBA Emergency Assistance Loans

We understand many of you are trying to figure out how to best protect your family and business during this difficult time. Many of you are now eligible for relief. We stand by our clients and are here to help you determine your best strategy.

The Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) is the largest federal relief package in history and provides financial support and tax incentives for small businesses.

What types of loans are available?

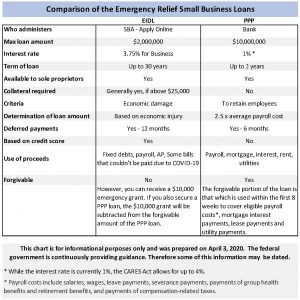

Two of the loans available through the Small Business Administration are the Economic Injury Disaster Loan (EIDL) and the Paycheck Protection Program (PPP).

There is a forgiveness structure that can effectively turn a portion of the PPP loan into a grant and you may be eligible for a $10,000 emergency grant by applying for the EIDL.

It is important to determine which loan is right for your business. We can guide you through the process to help you achieve the best outcome.

We offer a consultation service that covers the following:

- Business Assessment

- Loan Strategy Discussion

- Review Required Document Checklist

- Business Documentation Review

- Loan Application ReviewSBA Emergency Loan Comparison-Final

Email Attorney Jason Rosen for more information: [email protected].

Who Qualifies?

- A small business with fewer than 500 employees

- A small business that otherwise meets the SBA’s size standard

- A 501(c)(3) with fewer than 500 employees

- An individual who operates as a sole proprietor

- An individual who operates as an independent contractor

- An individual who is self-employed who regularly carries on any trade or business

- A Tribal business concern that meets the SBA size standard

- A 501(c)(19) Veterans Organization that meets the SBA size standard

In addition, some special rules may make you eligible:

- If you are in the accommodation and food services sector (NAICS 72), the 500-employee rule is applied on a per physical location basis

- If you are operating as a franchise or receive financial assistance from an approved Small Business Investment Company the normal affiliation rules do not apply

REMEMBER: The 500-employee threshold includes all employees: full-time, part-time, and any other status.

What documentation may you need?

While our firm is awaiting further guidance from the federal government regarding the loan application process, collecting the documents below is a good place to start. Insufficient documentation could delay the loan application. This list may change as more information becomes available.

- 2019 IRS Quarterly 940, 941 or 944 payroll tax reports

- Payroll reports for a twelve-month period (ending on your most recent payroll date), which will show the following information:

Gross wages for each employee, including officer(s) if paid W-2 wages.

Paid time off for each employee

Vacation pay for each employee

Family medical leave pay for each employee

State and local taxes assessed on an employee’s compensation

- 1099s for independent contractors for 2019

- Documentation showing total of all health insurance premiums paid by the company owner(s) under a group health plan. Include all employees and the company owners.

- Document the sum of all retirement plan funding that was paid by the company owner(s) (do not include funding that came from employees out of their paycheck deferrals). Include all employees and the company owners. Also include 401K plans, Simple IRA, SEP IRA’s.

- Company bylaws or operating agreement

US Patent & Trademark Office Waives Fees in Response to Coronavirus Outbreak

The United States Patent and Trademark Office (USPTO) issued a notice on March 16th to offer relief for certain inventors and entrepreneurs who were affected by the Coronavirus outbreak. The notice states the USPTO “considers the effects of the Coronavirus outbreak that began in approximately January 2020, to be an extraordinary situation within the meaning of 37 CPR 1.183 and 37 CPR 2.146 for affected patent and trademark applicants, patentees, reexamination parties, and trademark owners.”

Patent applicants will be able to file a petition to revive and the PTO will waive the fee for those who were unable to “timely reply to an Office communication due to the effects of the coronavirus outbreak, which resulted in the application being held abandoned or the reexamination prosecution terminated or limited.”

The petition to revive must include a copy of the notice and a statement that “the delay in filing the reply required to the outstanding Office communication was because the practitioner, applicant, or at least one inventor, was personally affected by the Coronavirus outbreak such that they were unable to file a timely reply.” The petition must be filed no later than six months after the date the application became abandoned or the reexamination prosecution was terminated or limited in order to be entitled to a waiver of the petition fee under 37 CPR 1. l 7(m).

The USPTO is also waiving fees for trademark applications and registrations that were abandoned or canceled/expired due to inability to timely respond to a trademark-related Office communication as a result of the effects of the Coronavirus outbreak, however, the petition must be filed no later than two months of the issue date of the notice of abandonment or cancellation. Download the full notice: coronavirus_relief_ognotice_031620201.

Questions or concerns about your Patents or Trademarks? Call us at 864-973-6688 for a consultation.