We understand many of you are trying to figure out how to best protect your family and business during this difficult time. Many of you are now eligible for relief. We stand by our clients and are here to help you determine your best strategy.

The Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) is the largest federal relief package in history and provides financial support and tax incentives for small businesses.

What types of loans are available?

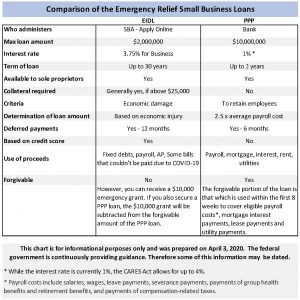

Two of the loans available through the Small Business Administration are the Economic Injury Disaster Loan (EIDL) and the Paycheck Protection Program (PPP).

There is a forgiveness structure that can effectively turn a portion of the PPP loan into a grant and you may be eligible for a $10,000 emergency grant by applying for the EIDL.

It is important to determine which loan is right for your business. We can guide you through the process to help you achieve the best outcome.

We offer a consultation service that covers the following:

- Business Assessment

- Loan Strategy Discussion

- Review Required Document Checklist

- Business Documentation Review

- Loan Application ReviewSBA Emergency Loan Comparison-Final

Email Attorney Jason Rosen for more information: [email protected].

Who Qualifies?

- A small business with fewer than 500 employees

- A small business that otherwise meets the SBA’s size standard

- A 501(c)(3) with fewer than 500 employees

- An individual who operates as a sole proprietor

- An individual who operates as an independent contractor

- An individual who is self-employed who regularly carries on any trade or business

- A Tribal business concern that meets the SBA size standard

- A 501(c)(19) Veterans Organization that meets the SBA size standard

In addition, some special rules may make you eligible:

- If you are in the accommodation and food services sector (NAICS 72), the 500-employee rule is applied on a per physical location basis

- If you are operating as a franchise or receive financial assistance from an approved Small Business Investment Company the normal affiliation rules do not apply

REMEMBER: The 500-employee threshold includes all employees: full-time, part-time, and any other status.

What documentation may you need?

While our firm is awaiting further guidance from the federal government regarding the loan application process, collecting the documents below is a good place to start. Insufficient documentation could delay the loan application. This list may change as more information becomes available.

- 2019 IRS Quarterly 940, 941 or 944 payroll tax reports

- Payroll reports for a twelve-month period (ending on your most recent payroll date), which will show the following information:

Gross wages for each employee, including officer(s) if paid W-2 wages.

Paid time off for each employee

Vacation pay for each employee

Family medical leave pay for each employee

State and local taxes assessed on an employee’s compensation

- 1099s for independent contractors for 2019

- Documentation showing total of all health insurance premiums paid by the company owner(s) under a group health plan. Include all employees and the company owners.

- Document the sum of all retirement plan funding that was paid by the company owner(s) (do not include funding that came from employees out of their paycheck deferrals). Include all employees and the company owners. Also include 401K plans, Simple IRA, SEP IRA’s.

- Company bylaws or operating agreement

Latest Posts

Welcome Max Young, legal extern

Welcome Max Young to our Team We are delighted to introduce Max Young, a third-year student at the University of South Carolina Joseph F. Rice School of...

Doug Kim named to South Carolina 50 Most Influential list

Kim Lahey & Killough Firm Founder Doug Kim named to South Carolina 50 Most Influential list Kim Lahey & Killough is proud to announce that its firm...

Doug Kim named to SC Biz South Carolina 500 list

Founding attorney Doug Kim named to SC Biz South Carolina 500 list Kim Lahey & Killough is pleased to announce that our firm founder Doug Kim has been...