Update on PPP Loan: $150 Billion Still Untapped

SBA Data Shows $150 Billion In PPP Loans Still Untapped

Reuters (5/26, Saphir, Schneider) reports that while the SBA’s PPP loan program “remains active,” data from the SBA “shows net weekly PPP lending has actually been negative since mid-May, as fewer firms applied for loans, and some borrowers returned funds.” Reuters adds, “All told, the SBA says it had approved $512.2 billion in PPP loans as of May 21. That’s nearly $150 billion less than the $660 billion allocated to the program, which was designed to keep Americans on company payrolls and off unemployment assistance.” The article adds that business owners “are now worried that confusing and changing rules may keep them from converting the money to a grant, meaning they will need to pay it back. To ensure forgiveness, for instance, firms need to spend three-quarters of the funds on payroll. But for some firms that doesn’t leave enough to cover overhead. Others don’t have enough work to justify rehiring many of their pre-crisis staff.”

Hoyer Says House And Senate Close On PPP Loan Extension

Bloomberg (5/26, Wasson, House) reports, “House Majority Leader Steny Hoyer said the House and Senate should be able to quickly agree on changes to the Small Business Administration’s popular Paycheck Protection Program to give loan recipients more flexibility in using funds. The House is poised to pass a bill on Thursday that would extend the current eight-week period during which businesses must use funds to have loans forgiven to 24 weeks or Dec. 31, whichever comes sooner. It would let businesses repay loans over five years instead of two, and scrap a rule that no more than 25% of proceeds can be spent on expenses. The House also plans to take up a bill to increase transparency in the program.” The article adds the “timing matters because the first companies that received loans after the PPP program opened on April 3 will see the eight-week loan-forgiveness periods begin to expire at the end of this week and in early June.”

CQ Roll Call (5/27, McPherson) reports, “On Thursday, the House will turn its attention to legislation tweaking the terms of the Paycheck Protection Program that Congress created as part of a roughly $2 trillion coronavirus relief package in March.” The article adds, “A bipartisan bill from Reps. Dean Phillips, D-Minn., and Chip Roy, R-Texas, would change the current eight-week period businesses have to spend the money and qualify for loan forgiveness to 24 weeks. The Senate last week reached bipartisan agreement to change the loan forgiveness period to 16 weeks but did not pass its bill before recessing.” In addition, the House will vote Thursday on a bill requiring the SBA “to publish a list of businesses that have received more than $2 million in PPP or economic injury disaster loans and other information about the loan approvals. Committees start remote hearings”

The Hill (5/26, Carney, Brufke) reports, “In addition to changing the period of time for businesses to spend PPP loans, the House will also take up legislation requiring the Small Business Administration to publicly publish information on recipients of PPP and emergency disaster loans.”

Download Your PPP Loan Forgiveness Application

Last week the Small Business Administration released an updated PPP Loan Forgiveness Application.

To apply for forgiveness of your Paycheck Protection Program (PPP) loan, you must complete the application as directed, and submit it to your Lender (or the Lender that is servicing your loan). Borrowers may also complete the application electronically through their Lender.

Need help? Read our article about “Making Sense of SBA Emergency Assistance Loans,” or reach out to Attorney Jason Rosen for more information: [email protected].

Making Sense of SBA Emergency Assistance Loans

We understand many of you are trying to figure out how to best protect your family and business during this difficult time. Many of you are now eligible for relief. We stand by our clients and are here to help you determine your best strategy.

The Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) is the largest federal relief package in history and provides financial support and tax incentives for small businesses.

What types of loans are available?

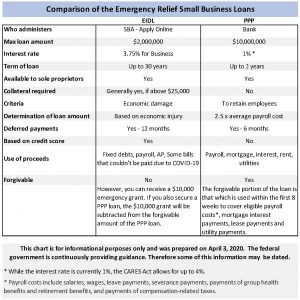

Two of the loans available through the Small Business Administration are the Economic Injury Disaster Loan (EIDL) and the Paycheck Protection Program (PPP).

There is a forgiveness structure that can effectively turn a portion of the PPP loan into a grant and you may be eligible for a $10,000 emergency grant by applying for the EIDL.

It is important to determine which loan is right for your business. We can guide you through the process to help you achieve the best outcome.

We offer a consultation service that covers the following:

- Business Assessment

- Loan Strategy Discussion

- Review Required Document Checklist

- Business Documentation Review

- Loan Application ReviewSBA Emergency Loan Comparison-Final

Email Attorney Jason Rosen for more information: [email protected].

Who Qualifies?

- A small business with fewer than 500 employees

- A small business that otherwise meets the SBA’s size standard

- A 501(c)(3) with fewer than 500 employees

- An individual who operates as a sole proprietor

- An individual who operates as an independent contractor

- An individual who is self-employed who regularly carries on any trade or business

- A Tribal business concern that meets the SBA size standard

- A 501(c)(19) Veterans Organization that meets the SBA size standard

In addition, some special rules may make you eligible:

- If you are in the accommodation and food services sector (NAICS 72), the 500-employee rule is applied on a per physical location basis

- If you are operating as a franchise or receive financial assistance from an approved Small Business Investment Company the normal affiliation rules do not apply

REMEMBER: The 500-employee threshold includes all employees: full-time, part-time, and any other status.

What documentation may you need?

While our firm is awaiting further guidance from the federal government regarding the loan application process, collecting the documents below is a good place to start. Insufficient documentation could delay the loan application. This list may change as more information becomes available.

- 2019 IRS Quarterly 940, 941 or 944 payroll tax reports

- Payroll reports for a twelve-month period (ending on your most recent payroll date), which will show the following information:

Gross wages for each employee, including officer(s) if paid W-2 wages.

Paid time off for each employee

Vacation pay for each employee

Family medical leave pay for each employee

State and local taxes assessed on an employee’s compensation

- 1099s for independent contractors for 2019

- Documentation showing total of all health insurance premiums paid by the company owner(s) under a group health plan. Include all employees and the company owners.

- Document the sum of all retirement plan funding that was paid by the company owner(s) (do not include funding that came from employees out of their paycheck deferrals). Include all employees and the company owners. Also include 401K plans, Simple IRA, SEP IRA’s.

- Company bylaws or operating agreement